Excerpts from "Beat the Market the Easy Way" by Sy Harding

"Sell in May and Go Away"

"Ned

Davis Research Inc. published numerous studies showing the positive

historical results of being invested in the markets for the seven month

period of October 1 to May 1, and being in cash the other five months."

"Thus

an investor standing aside during the market's infavorable seasons not

only matched the buy and hold performance of the S&P 500 and did so

with only 50% of market risk, but also avoided the emotional stress of

seeing portfolios often plunge precipitously during unfavorable

seasons."

"IT IS NOT A FIXED 6-MONTHS IN, 6-MONTHS OUT!"

It

is BEST to read this book. The book is available at many libraries,

either in paper or digital versions or it can be purchased easily

online.

In summary, after the research made by

Ned Davis Research Inc., Yale Hirsch of the Hirsch Organization and Alan

Newman, editor of the Crosscurrents newsletter, Sy Harding's firm,

Asset Management Research Corp. conducted more detailed research. In

their research they found that when the Moving Average Convergence

Divergence (MACD), developed by Gerald Appel, was applied, the

performance was much better.

"It works this way in our (Sy Harding's) seasonal strategy."

"If

MACD is on a technical buy signal, indicating a rally is underway, when

the

October 16 earliest calendar date for seasonal entry arrives, we

will enter at that time."

"However, if the MACD indicator is on a

sell signal when the

October 16 calendar date arrives, indicating a

market decline is underway it would not make sense to enter before that

decline ends, even though the average best calendar entry date has

arrived. In that event, our (Sy Harding's) Seasonal Timing Strategy

simply waits to enter until MACD gives it's next buy signal, indicting

that the decline has ended."

Use the same method in reverse when April 20 arrives to better pinpoint the end of the markets favorable period in the Spring.

Please

take the time to read Sy Harding's book. It is relatively short and

easy to read and it has many more exciting findings by Sy Harding.

|

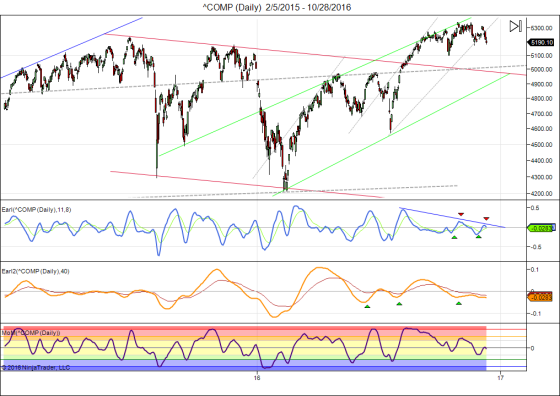

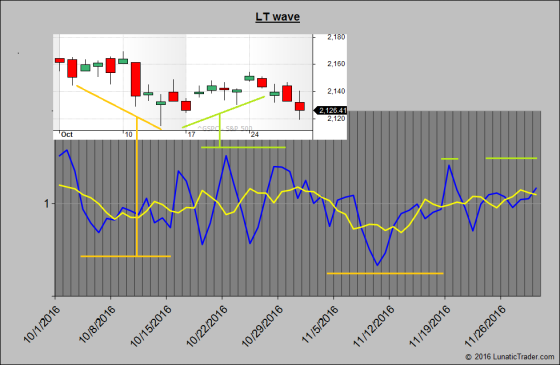

| Courtesy of Worden Bros. Oct 25,2016 |

|

| Courtesy of Worden Bros. Oct 25,2016 |

Keep following JustSignals using Twitter, @StockTwits or Follow By Email.

Just submit your email address in the box on the Blog homepage

This

has been posted for Educational Purposes Only. Do your own work and

consult with Professionals before making any investment decisions.

Past performance is not indicative of future results