Tomorrow is Tuesday December 1,2015

DJIA gains more on first day than all other days

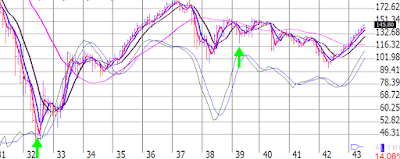

Over the last 15 1/4 years the Dow Jones Industrial Average has gained more points on the first trading days of all months than all other days combined. While the Dow has gained 5481.72 points between September 2, 1997 (7622.42) and December 31, 2012 (13104.14), 5323.19 points were gained on the first trading days of these 184 months. The remaining 3674 trading days combined gained just 158.53 points during the period. This averages out to gains of 28.93 points on first days, in contrast to only 0.04 points on all others. See Table 1.Note that September 1997 through October 2000 racked up a total gain of 2632.39 Dow points on the first trading days of these 38 months (winners except for seven occasions). But between November 2000 and September 2002, when the 2000-2002 bear markets did the bulk of their damage, frightened investors switched from pouring money into the market on that day to pulling it out in fourteen months out of twenty-three. This netted a 404.80 Dow point loss. The 2007-2009 bear market lopped off 964.14 Dow points on first days in 17 months from November 2007 to March 2009. First days had their worst year in 2011, declining seven times for a total loss of 644.45 Dow points.

First days of June have performed worst. Triple digit declines in four of the last five years have resulted in the worst net loss. August is the second net loser. In rising market trends, first days perform much better as institutions are likely anticipating strong performance at each month’s outset. S&P 500 first days track the Dow’s pattern closely but NASDAQ first days are not as strong with weakness in April, August, and October.

Courtesy of Jeffrey A. Hirsch

For more information contact

JEFFREY A. HIRSCH, editor-in-chief of the Stock Trader's Almanac and Almanac Investor newsletter, and the author of The Little Book of Stock Market Cycles (Wiley, 2012).

www.stocktradersalmanac.com

Keep following JustSignals using Twitter, @StockTwits or Follow By Email.

Just submit your email address in the box on the Blog homepage

This

has been posted for Educational Purposes Only. Do your own work and

consult with Professionals before making any investment decisions.

Past performance is not indicative of future results